Contents:

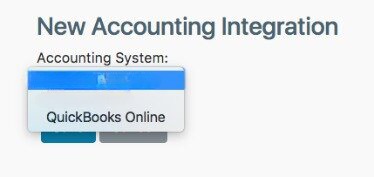

If the issue persists, I recommend usingother supported browsersso we can check if this is a browser-integrated issue. For future reference, read through this article to learn more aboutmanaging default and special accounts in your chart of accounts. Give your new subaccount a name, then selectWhen do you want to start tracking your finances from this account in QuickBooksoption.

The opening balance equity account receives an incorrect credit for a transaction. By following this accounting standard, you will have a chart of accounts that accurately reflects your business’s ability to make a profit, generate income and create equity. Single member LLC has the same equity accounts as a sole proprietorship. Owner equity is calculated by subtracting liabilities from business assets and is described in the company’s balance sheet.

By using an equity account, you’ll have a better understanding of how much money you are putting into your business, as well as how much money you are taking out of your business. If their business needs additional money, they’ll invest money into it. If their business is doing well and has an excess amount cash on hand, they’ll draw money out of it. QuickBooks transfers the company’s net income into the company’ retained earnings account at the end of the tax year. Retained earnings is a company equity account that shows net income not distributed to partners. LLCsneed to reflect the fact that multiple parties have equity in the business.

Restaurants especially have a tough task of opening new locations if the startup costs aren’t figured out. Being able to show investors a solid set of books with the exact costs to get a new location started speaks great volume. After setting up an equity account for one partner, you can separate multiple owner equity accounts in QuickBooks. As you’re filling out the info on the equity account, just select Is sub-account, and then enter the parent account. A company that has investors or is run as a partnership, can track the equity of each person easily through QuickBooks. The equity of the company is equal to its assets minus the liabilities it has.

How to Set up Owners Equity Account in QuickBooks?

Expenses arecontra equity accountswith debit balances and reduce equity. In this case, it’s most probably the open balance equity account. To adjust the opening balance of the bank account, the balance of this account will now be temporarily set to $100.

An owner’s investment, on the other hand, is money that you transfer out of your personal bank account and into your business’s account. In an equity account, you’ll find these transactions listed. When you set up QuickBooks initially, a wizard guides you through a list of your company’s assets and liabilities.

Your Guide to Growing a Business The tools and resources you need to take your business to the next level. Accounting Accounting and bookkeeping basics you need to run and grow your business. Your Guide to Running a Business The tools and resources you need to run your business successfully. Small Business Stories Celebrating the stories and successes of real small business owners. Your Guide to Starting a Business The tools and resources you need to get your new business idea off the ground.

Our Services

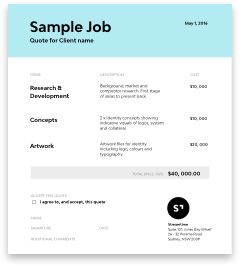

We provide you support through different channels (Email/Chat/Phone) for your issues, doubts, and queries. We are always available to resolve your issues related to Sales, Technical Queries/Issues, and ON boarding questions in real-time. You can even get the benefits of anytime availability of Premium support for all your issues. Now, finally, enter the amount of the equity in the required column. At the time of setup of New Customers or Vendors, the opening balance is recorded. This amount is a certain pile of money that business organizations use to maintain their treasury.

Friday Footnotes: KPMG Client’s Spectacular Failure; PwC Gets Defensive; Kids Doing Taxes 3.10.23 – Going Concern

Friday Footnotes: KPMG Client’s Spectacular Failure; PwC Gets Defensive; Kids Doing Taxes 3.10.23.

Posted: Fri, 10 Mar 2023 22:00:49 GMT [source]

The cost of items contains all the expenses which take place in business like payroll, advertising, taxes, and rent. Open the personal bank account then make a new entry as an increase. You’ll also want to close Retained Earnings to each capital account on 1/1 of the following year so that capital accounts equal the tax return.

What Is The Owner’s Equity Account In QuickBooks?

If you were to create a company that had a large positive or negative balance on day one, it would be impossible to balance the books later on. Create a sub-account to the partner’s capital account to record the amount of investment by the partner. This sub-account tracks each time the partner invests funds into the company and the total amount of the partner’s investment. There is a basic overview of equity accounts and how their interact with the overall equity of the company. Withdrawals have a debit balance and always reduce the equity account.

It will also decrease if you have expenses and losses in your business. In general, it is considered to be an asset of a company that excludes any loss or expenses. The number of investments your company fetches gets calculated and how much each investor withdraws from your equity funds is also part of it. Sole proprietorship – When there’s just one owner in a business, the equity accounts are owner’s capital, owners draw and retained earnings.

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

Remember the saying “less is best,” when it comes to your chart of accounts. Here are some of the best practices to follow to improve and maintain your chart of accounts. Owner’s capital represents the cash that the owner has personally put into the business. Change the balance equity to “Retained Earnings” if your company is a corporation.

How to Enter an Opening Balance in Quick Books Sales Tax Payables Account

Also, you can simplify and automate the https://bookkeeping-reviews.com/ using Dancing Numbers which will help in saving time and increasing efficiency and productivity. Just fill in the data in the relevant fields and apply the appropriate features and it’s done. Equity can be created by either owner contributions or by the company retaining its profits. When an owner contributes more money into the business to fund its operations, equity in the company increases. Likewise, if the company producesnet incomefor the year and doesn’t distribute that money to its owner, equity increases.

In the new window, a drop-down managing dishonoured payments in xero for Type lists the types of account QuickBooks can create, including Ban, income, expense, fixed asset, accounts payable and equity. Equity accounts, like liabilities accounts, havecredit balances. This means that entries created on the left side of an equityT-accountdecrease the equity account balance while journal entries created on the right side increase the account balance. Balances are added to Opening Balance Equity when opening balances are entered in QuickBooks. Investors can also view their shares and stocks’ values in compliance with other investors in the business.

To review the transactions in Opening Balance Equity account a report of the transactions is first created. If an item is created in AdvancePro and stock is added (via initial stock/adjustment or VPO) before the item exports to QuickBooks, the identical scenario occurs. QuickBooks creates the item with an initial on hand quantity and the total value is posted to the ‘Open Balance Equity’ account. Any inventory adjustment posted to this account should be moved to the appropriate adjustment account. In this article, you learned all about the chart of accounts. You saw that there are several ways to access the chart of accounts.

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

Equity accounts aren’t always intuitive or easy to decipher. To add to the confusion, terminology for these accounts can vary wildly. Put simply, they represent the assets you have invested in your business, so they’re important to understand and monitor. It is best to transfer opening balance equity accounts to retained earnings or owner’s equity accounts. To track the money you withdraw from the business, you can set up and use a new owner’s equity account called something like Owner’s Draws.

Opening accounts payable transactions on accrual basis as of the start date. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

Whatever is your option for not impacting sales tax, because this is not something that should have sales tax implications. We’re taking the money from the checking account to ourselves, and we’re going to save and close. So now we’re going to enter the draw because we’re taking funds from our business and it’s not an expense to the business.

Opening Balance Equity accounts show up under the equity section of a balance sheet along with other equity accounts like retained earnings. If we have a look down in our equity section, we can see that there’s $500 has been taken out of the business. So we have a quick look at the balance sheet, we’ll be able to see how that looks as well. Now keep in mind, because this is a account, it’s going to increase over time.

You also learned about all the different types of accounts that are available and how they are put into different categories, such as income, expense, and balance sheet account. And how to add them, edit them, deactivate them, and the activate them again. Once you are at the chart of accounts, you will see a table with all the relevant information about your company. QuickBooks Online creates the chart of accounts automatically based on the industry and type of company that you specified when making your company file. For a new file, you will need to enter your accounts’ opening balances.

0 Comments